Is a 1980 One Dollar Coin Worth Anything Today? The Answer Isn’t Obvious

The question regarding the value of a 1980 dollar coin requires separating the concepts of face value and numismatic value.

Most specimens of the Susan B. Anthony series found in circulation maintain parity with the face value, amounting to exactly one U.S. dollar.

However, a narrow segment of coins possessing exceptional preservation characteristics or production defects demonstrates different price indicators.

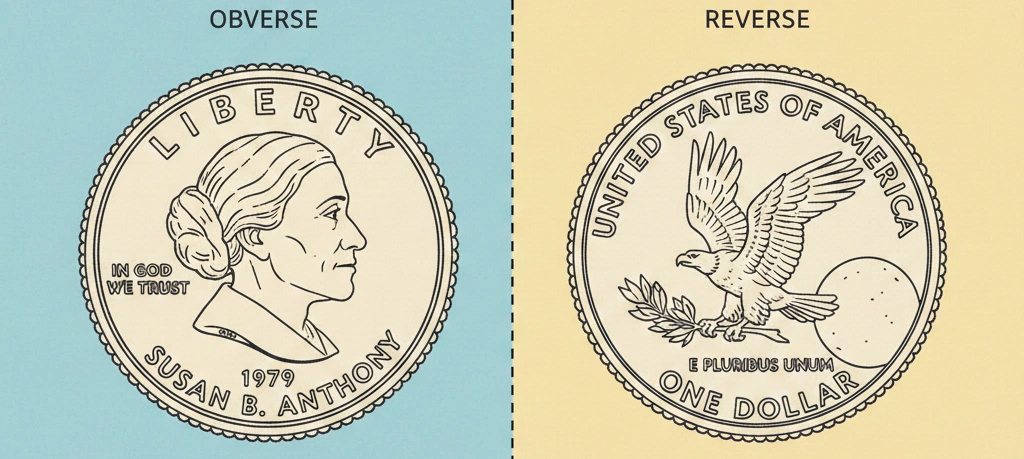

Correct 1980 one dollar coin value identification requires considering the physical properties of the item established by law during the minting period.

This coin contains no precious metals, limiting its intrinsic value to the price of scrap non-ferrous metal.

Parameter | Description |

Composition | Copper-nickel clad layer on a copper core (75% Cu, 25% Ni) |

Weight | 8.1 grams |

Diameter | 26.5 mm |

Edge Type | Reeded |

Mint Mark | P (Philadelphia), D (Denver), S (San Francisco) |

The absence of silver makes the coin insensitive to fluctuations in precious metal prices.

This implies total dependence of the market price on the rarity of the grade according to the Sheldon scale.

1980 Mintage Statistics by Mint Facility

Production volume in 1980 decreased significantly compared to the debut year of 1979, theoretically increasing the value of preserved specimens.

Nevertheless, the total number of issued coins remains high enough to ensure mass supply.

Philadelphia (P): 27,610,000 pcs.

Denver (D): 41,628,708 pcs.

San Francisco (S): 20,422,000 pcs.

San Francisco (S) Proof: 3,554,806 pcs.

In total, the U.S. Mint produced over 93 million coins of this type in 1980.

Mintage distribution indicates that Philadelphia Mint coins occur most rarely in standard business strike quality.

Value Based on Grade

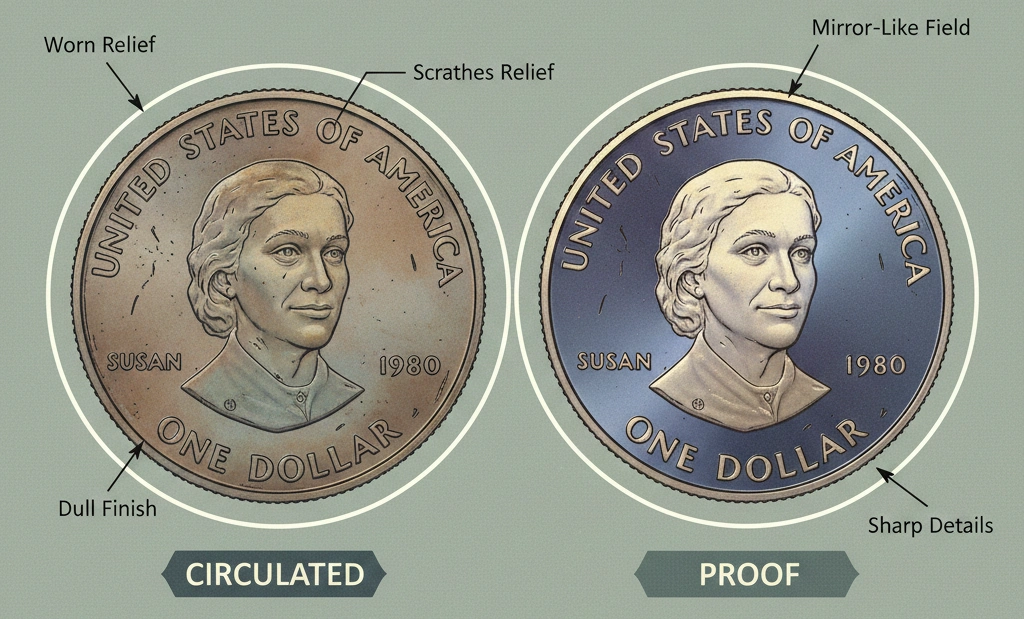

Pricing in the numismatic market follows a strict hierarchy of conditions confirmed by the coin value app, PCGS, or NGC certificates.

Coins showing signs of wear (from Very Fine to About Uncirculated) possess no additional value.

Condition (Grade) | 1980-P (USD) | 1980-D (USD) | 1980-S (USD) | 1980-S Proof (USD) |

MS63 | $2 - $3 | $2 - $3 | $2 - $3 | - |

MS65 | $10 - $14 | $12 - $16 | $10 - $14 | - |

MS66 | $18 - $25 | $22 - $30 | $18 - $25 | - |

MS67 | $55 - $85 | $75 - $110 | $45 - $65 | - |

MS68 | $1,800+ | $1,400+ | $450+ | - |

PR70 DCAM | - | - | - | $150 - $220 |

The sharp price jump when transitioning from MS67 to MS68 stems from the scarcity of certified specimens in the highest grade.

In PCGS registries, the number of 1980-P coins in MS68 grade is measured in units, creating a situation of high auction demand.

Auction Records and Price Dynamics

Historical sales data on Heritage Auctions platforms show maximum value boundaries.

These figures refer to coins possessing ideal mint luster and an absence of "bag marks" (scratches from contact in mint bags).

1980-P (MS68 PCGS): Sold in 2017 for $2,820.

1980-D (MS68 PCGS): Sold in 2022 for $1,645.

1980-S (MS68 PCGS): Sold in 2011 for $920.

Observed statistics indicate an annual price increase in the MS68 segment at a level of 4–7%.

Meanwhile, the MS65–MS66 segment demonstrates stagnation, maintaining price levels seen a decade ago.

Mint Errors

The presence of technological defects makes an ordinary 1980 coin an object of professional interest.

The value of such specimens is not tied to tabular values and is determined individually.

Off-Center Strike: Image displacement relative to the planchet center by 25–50% increases the price to $150–$350.

Broadstruck: Minting without using a retaining collar, increasing the coin's diameter, is valued at $50–$120.

Multiple Strikes: The presence of several die impressions on a single planchet can increase the value to $500 and higher.

Struck on a Different Planchet: Cases of minting on planchets for other denominations (e.g., on a nickel planchet) are extremely rare and cost over $1,000.

Low Issue Popularity

The 1980 Susan B. Anthony dollar is considered a commercially unsuccessful U.S. Mint project.

This directly affects modern mintage distribution and coin availability.

Similarity to the Quarter: Similar size and identical color led to errors during transactions, causing mass returns of coins to banks.

Long-term Storage: Huge batches of the 1980 mintage remained sealed in bank vaults until 1999.

Die Preservation: In 1980, dies were used more efficiently than in 1979, resulting in fewer errors compared to the previous year.

Investment Attractiveness and Risks

Considering the purchase of a 1980 dollar as an asset requires accounting for the liquidity of different grades.

Investments in coins below MS67 yield no profit due to high commission costs for resale.

Grading Costs: Certification costs (from $25 to $50 per coin) often exceed the market price of the item itself.

Oxidation Risk: The copper-nickel alloy is susceptible to dark spots appearing during improper storage, automatically lowering the grade.

Growth Rates: In percentage terms, the yield for MS68 coins is approximately 50% over the last 10 years, trailing the performance of the S&P 500 index.

Procedure for Identifying

Performing a sequence of actions is necessary for determining the potential value of a 1980 coin with and without the free coin identifier app.

Check for the absence of circulation signs (scratches on Susan B. Anthony's cheek, hair wear, lettering abrasions).

Evaluate the intensity of mint luster under a directed light source.

Compare the mint mark; the presence of the "S" mark (San Francisco) on a standard coin often indicates higher preservation.

Exclude traces of cleaning, being a reason for the denial of a numerical grade.

Storage and Conservation

Surface condition is the sole guarantor of value for 1980 coins.

Using specialized accessories prevents metal degradation.

Airless capsules made of inert plastic.

Storage in dry rooms with controlled humidity.

Minimizing contact with hand skin to prevent grease spots from occurring.

Market Status

The answer to the question regarding the value of a 1980 dollar is negative for 99.9% of all existing coins of this issue.

Market activity is concentrated exclusively around exceptional specimens having passed strict selection by professional experts.

Statistics confirm that a 1980 coin is worth more than face value only with the presence of an official slab (plastic container) with a grade of MS67 or higher.

In all other cases, these coins remain merely a payment tool or an object for initial acquaintance with U.S. numismatics.

The long-term forecast does not anticipate sharp price growth for this issue due to the lack of historical scarcity and material value.